I always wonder why our government here in the US uses a double set of standards in accounting.

If you own a business or company that is "public" you are required to report your financial information according to FASB - a standardized set of accounting rules. This ensures that company A reports profits and losses the same way as company B so that investors who purchase shares of a company (or who work there) have a rational understanding of how the company is doing.

Congress, states and other non-corporate municipal entities are under no such obligation. They can report however they like. Now certainly if they sell bonds then they have to follow the rules there but in general there is little to pin down exactly where things are financially - after all - these are governments and they'll never default, right?

Well, I found this the other day at the WSJ:

"... For example, if Congress had submitted fiscal year 2010 financial reports of our country in a fashion similar to a corporation, the U.S. would show a negative net worth of $44 trillion, an operating loss of $817 billion, and $1.3 trillion of negative cash flow..." (from this).

Now what this means is that Congress (the USA) owes about three full years of Gross Domestic Product (3 x $15 trillion USD) in debt while spending $1.3 trillion USD more than it took in.

Personally I believe the "net worth" number is probably much larger due to social security, medicare and other long term obligations.

Congress does not have to account for these, though, in its budgets - which is fantastically childish, irresponsible and foolhardy.

The congressional view of "financial obligation" revolves around the fiction that a "budget" is only for one year, i.e., can I cover my costs for this year only.

And most troubling they are under no obligation to account for more than the current interest payments due on debt in the current year. So this is more or less like a twenty year old kid with their first credit card running up a bill they don't really understand the magnitude of long term.

This year's Congress is only concerned with whether or not they can make the payments and not what payments do to the country in subsequent years.

So the mentality goes like this in the Congress:

"Its November and I want to by a Maserati. Now it costs $250K but I only have $20K in my pocket. If I buy it on time I'll only need to make two $10K payments this year. My car budget for this year is $20K so I am in like Flynn!" I go down to the dealership and close the deal.

This is a familiar story to anyone with adult children learning to live on their own.

What's even more fascinating is that even if the Congress took every penny every person and company in the entire USA made for a year they'd only have about $14 trillion USD.

That's the currently outstanding "borrowing" obligation of the US - but that's only in "short term notes" like US Bonds and excludes the aforementioned social security and so on. Basically this is like having an income of $50K and having credit card debt equal to $50K. Sure the "minimum payment"might only be around $1,500 USD - but the debt never goes down at that rate.

The $44 trillion "negative net worth" would be like, in addition to the $50K in credit card debt having a house on which you also owe $150K.

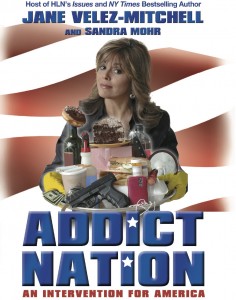

So to sum this all up the USA has a "debt addiction". Its an addiction because the Maserati mentality of buying things you cannot afford is tied up in a situation where the person is already in $200K worth of debt.

Just like with gambling and other addictions doing "more" of what your addicted to does not help the problem. After all, who hasn't at some point in their life been asked by a "relative" with a gambling or drug addiction for that extra $100 bucks to get them through whatever - all with the promise to repay you tomorrow (still holding your breath?)

This would be high comedy if it were not so tragic.

Now the country is faced with the following dilemma:

Big brother is $200K in debt on his $50K a year job - and the credit card companies are clamoring to cut him off - there is no longer joy at the bank - the mortgage is coming due, and so on.

Is big brother going to take every penny he earns for a year and pay off his credit cards?

Sure he is - but he needs you to loan him $1,000 USD so he can get started....

SO big brother figures he can confiscate little brother's money - beat him up, whatever, and get some cash. Now little brother has been down this road many times before.

What does little brother do?

He knows he's going to get beat and he knows his wallet is going to be lighter. Since he's the responsible one what does he do?

A) Borrow money.

B) Nothing.

C) Start hoarding and hiding cash from big brother.

If he's not stupid C because that's the only way to limit his overall losses.

This is also why the economy is crap - no one wants "big brother" and his debt addiction to harm them - so they sit and wait for big brother to go down or get his shit together. If they do get hit by him they want the result to do as little damage as possible.

And there you have the US economy in a single dysfunctional family nutshell.

From this: "Debt addiction is more than compulsive shopping. Someone who is addicted to debt uses debt as a crutch for solving their financial and personal problems without any plan for living differently or getting out of debt."

1) Its run so badly that they don't dare use their own legally required methods (imposed on "everyone else") to report on their own financial status (this is GA or AA calls "denial").

2) The use thuggery to extract from others to continue their addiction beyond what they themselves can afford.

3) They support their addiction by continuing to "borrow" what they cannot afford to borrow when they can borrow it.

Those that wink and look the other way are what again GA or AA call "enablers".

An "enabler" does not buy the drugs or go to the horse track - but they make sure that the one with the addiction is not hindered in his or her progress to self destruction.

"Oh, need a ride to the track? Sure, hop in..."

Enablers are just as bad as the addicted because they positively reenforce the addiction.

Take away the enablers and the addictee hits bottom quicker and harder. Often enablers and addtictees are co-dependent - read this about drug addiction to see how this applies here.

There days few people live without coming across the path of someone addicted to something.

The question is what do you do about it?

No comments:

Post a Comment